In the realm of global business, the trend towards decentralized structures is gaining momentum. These structures, with their proximity to local markets and significant informational advantages over centrally organized entities, are leading to an increased relevance of a concept known as transfer pricing.

What is Transfer Pricing?

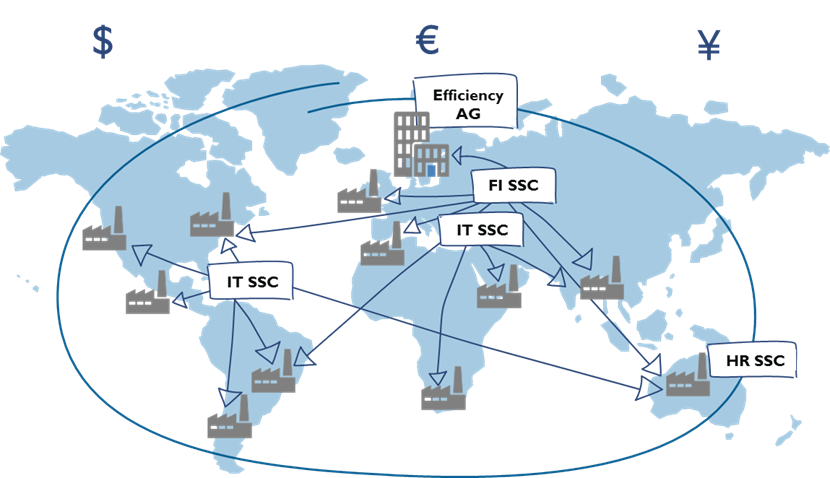

Transfer pricing refers to the process of determining the cost of goods or services exchanged between different entities or subsidiaries of a multinational company. It's a vital concept for global corporations conducting cross-border transactions.

The significance of transfer pricing becomes apparent when considering its impact on a company's financial performance. It influences the distribution of profits across the various entities within a corporation. Missteps in transfer pricing can lead to substantial tax implications, including penalties, double taxation, and reputational damage.

Challenges and Importance of Transfer Pricing

Given its potential impacts, transfer pricing presents unique challenges for global businesses. It calls for strict adherence to national and international tax regulations, comprehensive documentation of transactions, and consistency with the arm's length principle. This principle states that the prices charged for goods or services should resemble the prices for similar goods or services in a market transaction between unrelated parties.

Transfer pricing touches upon both fiscal and legal aspects of business, impacting a company's tax liability and regulatory compliance. With the ever-changing tax laws and regulations in different countries, multinational corporations need to stay updated to ensure that their transfer pricing policies align with local regulations.

Implementing Transfer Pricing

For a global corporation to have legally sound transfer pricing for shared services, it needs:

- Transparent calculation and analysis of transfer prices across a multi-layered value chain, extending to the primary expense receipts level.

- A clear depiction of service consumption (quantities) and the used settlement key (transaction matrix).

- A comprehensive representation and management of service contracts between service providers and recipients, serving as the legal basis of the supply relationship.

In essence, transfer pricing is a critical concept for multinational corporations engaging in cross-border transactions. It requires not only adherence to national and international tax regulations but also extensive documentation for each interaction and country involved.

The Arm’s Length Principle

The "arm's length principle" is the most widely accepted principle in tax law for transfer pricing. There are three primary methods to implement this principle:

- Comparable Uncontrolled Price (CUP) Method: This method involves comparing the prices of comparable services in the external market (benchmarking).

- Resale Price Method (RPM): Based on the price at which a product purchased from an associated enterprise is resold to an independent enterprise. The resale price is then reduced by the resale price margin.

- Cost Plus Method (CPM): A pricing strategy where the selling price is determined by adding a specific markup to a product's unit cost. This method emphasizes the importance of calculating the real unit costs of products and services.

Key Takeaways

When implementing transfer pricing, it's crucial to have transparency about your unit costs and total cost of ownership (TCO), avoid margin stacking, and set markups cost type specific even in complex value chains. By doing so, you can maintain regulatory compliance, effectively allocate profits, and ultimately, ensure the financial health of your corporation.

How to make your billing transparent, compliant and audit-proof

- Serviceware’s own software solution for the Financial Management of IT and Shared Services offers – among other things – functionalities for handling transfer pricing documentation. Read our free white paper.

- Our 30 minute webinar goes in-depth about transfer pricing and how we can help.

- Speak to an expert: Serviceware's cooperation with KPMG strengthens the joint offering for customers in the field of transfer pricing. Get in touch to find out how to make your billing transparent, compliant and audit-proof.

German

German